Mobile phone, music, and TV subscription services with monthly contracts have triggered a new wave of buying trends. This shift to staggered payments instead of one upfront cost is a compelling option for a business world looking to hold onto cash. As such, DaaS is playing a bigger role in how businesses procure and deploy technology.

Devices have a residual value and DaaS ensures companies maximise their assets. Resellers dovetailing DaaS with Software as a Service (SaaS), are already reaping impressive rewards.

Headset and telephony buy-back schemes have been successfully operating for many years and trade-in programmes encourage and offset the cost of new equipment. On the other hand, today’s Covid world means there is more emphasis on reducing the spread of germs. Device hygiene and cleaning programmes represent a great way to increase recurring revenue, improve equipment performance and build stronger bonds with your customers. To counteract potential issues, data cleansing is vital.

When asked why DaaS makes sense for customers in 2020, Gareth Thomas, head of CCD mobility and desktops at Fujitsu, said moving from a capital expenditure to an operating expenditure is great for customers to manage the cost of IT deployments to provide clear financial stability.

He added, “To keep device productivity high, we recommend users are kept up to date with modern device technology giving the user speed, agility and most of all, security. As part of all modern DaaS offerings you can spread the cost of your device & support over 3-5 years, with the option at the end to refresh the device, return them or keep at the same rate with a new agreement. Fujitsu take this one step further with a flexible but full deployment including device selection, pre deployment management, physical deployment engineering suite, in life support and recycling that is 100% customisable.”

This chimed with the view of Mark Skelton, chief technology officer at IT solutions and support specialist CANCOM. He said, “Businesses are struggling for working capital, so moving to an operational expenditure model makes sense. Organisations can invest in the technology they need to enable a modern mobile workforce without the upfront capital spend. In addition, companies are constantly changing shape, reducing or increasing head counts. This turbulent market is ideal for a DaaS model that can scale and contract in line with the workforce demands.”

Adopting DaaS

For resellers considering adopting a DaaS model, it important to understand the opportunities and the pitfalls. John Griffin, head of services & alliances at Fujitsu explained, “With Fujitsu it couldn’t be easier, we break this down into three simple packages making it easier to quote. We can even create a reseller specific package to use time and time again. We’ll work with the partner to ensure we can manage their capabilities as part of their offering and fill the gaps with the Fujitsu end to end PCaaS offering. We will also work with the end user’s IT department to ensure we manage their full expectations whilst keeping to timelines, but they only pay for the service the need. An extra benefit is that if the end user adopts the ability to go down the OPEX route, the reseller will get paid up front on the whole opportunity.”

Skelton commented, “Adopting a DaaS offer with a reseller can be challenging. It requires a cultural shift to a service centric model and many VARs of old have not operated in this manner. Additional roles within the resellers are required to adopt a true as a service operation.” He added that CANCOM has made significant investment in roles such as customer success managers, transformation and adoption consultants to deliver a true DaaS model – helping meet the “as a service” part of the offer.

Nick Offin, head of sales, marketing and operations at Dynabook Northern Europe, thinks CIOs must consider their current IT offering and its ability to be able to cope with changing environments. He said, “A tech refresh is about more than just devices – businesses need to consider how different technologies will play together within the broader infrastructure. This is where the channel comes in. Highlighting the long-term cost-effective nature of the model makes for a stronger case to act. Greater competition, greater user expectations and greater security threats all mean a seamless device fleet experience is essential from implementation through to end-of-life. A fully integrated DaaS option is key to achieving this, and the channel is best placed to offer this consultancy.”

Adding value

Like any new offering, partners will be looking for ways to add value around a DaaS proposition. CANCOM’s Skelton explained his company includes device provision, asset life cycling, self-service portals and service reporting as part of its DaaS offer. Fujitsu’s Thomas agreed creating value is vital. “We can scale our PCaaS offering to all partners no matter their size or delivery execution capability. If they want to remain hands on, then they pick the options that they would like Fujitsu to deliver. Or they can equally include all our services and add them to their own end customer service solution. All of which can form part of the final per use per month cost.”

Dynabook’s Offin added, “Within today’s increasingly advanced and complex IT architectures – incorporating cloud, IoT and edge solutions – the need to ensure a seamless roll-out and integration period is essential. If we take a look at the impact [of downtime] on small and medium-sized businesses, for example, 80% of companies have suffered downtime with a cost of $82,200 to $256,000 per incident. The value of removing these risks cannot be underestimated. Services which offer on-site installation, disablement of redundant devices and secure data migration across platforms all play a part in a seamless transition from old to new.”

Still come to

When asked what we will see from the DaaS market over the next 12-24 months, Fujitsu’s Griffin commented, “The market is constantly changing and customer requirements are constantly changing but, with the current market situation, the ability to flex up on devices is simple, flexing down is always a situation that can arise. As part of our offering we are looking to offer this ability for up to 25% of Fujitsu PCaaS and also the ability to work with our channel around wrapping PCaaS into a fully managed service. Watch this space.”

CANCOM’s Skelton is excited by the future potential of DaaS growth. “The trend is for more and more companies to move to a DaaS model to meet the demands of their businesses. We will see more competition in this space with partners looking to add more and more value into the service. The next wave will be how we can supply not just the laptops and desktops in a DaaS model but how we can bring phones and peripherals into a single DaaS contract.” He added that the company sees this as part of a much bigger opportunity around delivering a modern workplace as a service. This brings into scope delivering the operating system, productivity applications, management and security to reduce overall operational complexity. This, Skelton believes, ties into a broader trend of the consumerisation of IT operations – which will demand DaaS partners offer on demand self-service portals and delivery within short time frames.

Keep it clean

It’s not just the device itself where lucrative recurring revenue can be secured – health and hygiene programmes are vital amidst the Covid crisis. Headset schemes have been popular for many years, but data privacy company Blanccobelieves it’s vital to make sure devices (laptops, mobiles, hard drives) are properly sanitised in a different way, with data securely erased from devices.

Earlier this year, Blancco conducted a study, titled 5G Smartphone Upgrades and the Secondary Device Deluge, which found 68% of the 5,000 global consumers surveyed would be willing to trade-in their used device at the point of a 5G upgrade. Given the huge number of devices entering the secondary device market, there is opportunity for DaaS providers to access cheaper devices but only if security concerns, such as residual data left on old devices, can be overcome.

Christina Walker, global director of channel, Blancco, emphasised, “To maintain security integrity, data [must be] erased before the device is returned, repurposed, reused or retired. For our channel partners this is being pushed by the enterprise requirements themselves and has become part of their enterprise device management process.

“Major considerations are due to chain of custody, so even for GSIs or MSPs managing devices on behalf of an enterprise, part of the process mandated is erasing before it leaves the customers premise. This is pushed heavily by regulation requirements, now so more than ever, it is reflective of potential sensitive data breaches. Our partners add this as part of the DaaS portfolio for revenue opportunity, as well as rounding out their security message.”

Future proofing technology

David Silous-Holt, managing director of IT services and supply specialist Blue Orange, said DaaS has become a more natural way of future-proofing technology investments. “DaaS means you can progress to the latest technologies and it becomes a lot more affordable too. Items may have been out of reach with a one-off upfront purchase. I’m literally stood in a mobile phone shop now and they have promised a free upgrade to the latest handset. That’s a good example of the benefits of DaaS.”

Silous-Holt added, “From a reseller’s point of view they just have to make sure they have got all their ducks in a row, making sure funding is in place for example. Overall it’s quite easy and simplistic to do but you just need to make sure all the areas are covered. It could be a monthly or quarterly service, so you need to make sure your billing service is set-up. There are very few pitfalls and lots of advantages. It’s recurring revenue, all guaranteed.”

He emphasised that there are many other layers of service that can be added, including security, insurance and warranties. Blue Orange’s own wrap around end-to-end solution offers installation and an on-going contract to support devices.

Silous-Holt also pointed out infrastructure will play a key role as the sector moves forward. “The natural progression will be infrastructure-as-a-service. Obviously cloud services are continuing to thrive which generate cost savings. I think it will all expand. DaaS is at the front end, what everyone sees, but there’s a lot going on behind the scenes that makes it happen. This is where growth will occur too.”

DaaS and SaaS synergy

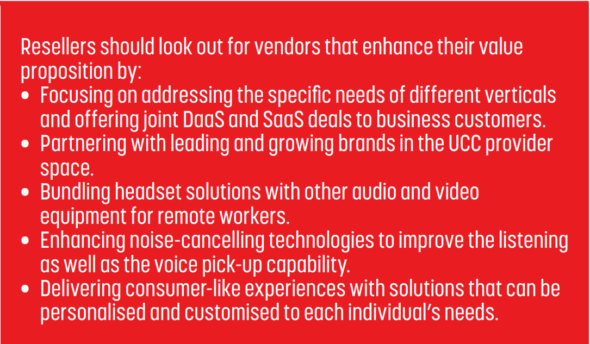

With a surge in cloud meeting services, the global professional headset market is expected to reach $2.94 billion by 2026. Frost & Sullivan’s latest analysis, Growth Opportunities in the Global Professional Headset Market, Forecast to 2026, highlights how addressing the needs of different verticals and offering joint DaaS and SaaS deals is a key route to success.

It predicts that the professional headset market will witness robust growth due to the increased popularity of cloud meeting services and remote working practices. In 2020, the demand for professional PC USB and UCC headsets has surged to unprecedented levels to enhance software communications experiences. The global professional headset market is expected to reach $2.94 billion by 2026 from $1.41 billion in 2019. That equates to shipping 65.7 million units, up from 22.9 million in 2019.

“2020 will be marked by unprecedented growth of professional headsets due to the Covid-19 pandemic and work-from-home requirements,” said Alaa Saayed, Director, Information & Communication Technologies, Frost & Sullivan. “While professional headset vendors have been challenged by supply-chain disruptions during the first half of 2020, Frost & Sullivan expects vendors to successfully cope with backlog issues during the second half of the year.”

Earning top marks

Trade-in programmes are another effective way of building business. The HP for Education trade-in programme offers special pricing, trade-in rewards and educational solutions to deliver even more value from HP technology investments.

Now in its eighth year, HP for Education has already given back several million pounds to educational establishments. This continues with an expanded and improved programme for 2020, with a greater focus on making a measurable impact in learning environments.