We are used to the theory of top to bottom trickle down for technology, but many are saying that this model of costly and sophisticated applications being sold initially only to Enterprises – after all they are big budget targets with greater in house skills, no longer applies in the world of the cloud.

Companies that herald huge applications that are suitable for any company size, say from five to ten users, all the way up to thousands of users clearly think the old enterprise order is long gone.

Nowhere does this scenario seem more evidenced than in the Unified Communications market where UCaaS versions seem to fit the 5 to 5000 user market with apparent ease.

So, what are Enterprise UC applications? Research (Google) pings up a number of well-known favourites such as;

• Hosted Voice

• Unified Messaging and Presence plus Collaboration

• Mobile Connectivity and Apps

• Video and Web Conferencing

• Existing Business App Integration

• Mobility

• Customisation

• Security

There can’t be too many readers who at this point would not consider these applications to be standard or readily available options to almost any UCaaS offering no matter what the size of the deployment. Perhaps customisation may prove to be somewhat limited for smaller installations.

Gamma is a good place to start when looking both for a place to begin and a channel reference point. Gamma’s Horizon hosted telephony platform is hugely popular and successful in the UK and last year the company added a number of UC applications in the form of Horizon Collaborate.

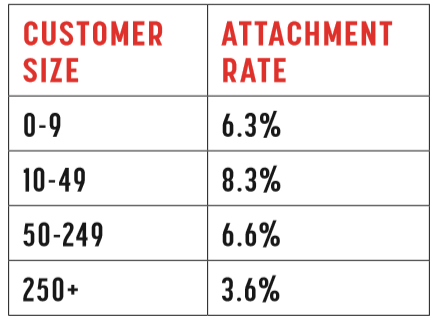

Applications will continue to be added and having attended one of their reseller roadshows recently the provider disclosed their UC ‘attachment rates’ for the Collaborate products.

Firstly, we must realise that Gamma Horizon is based upon the Broadsoft hosted telephony platform and therefore is a proven example of a solution that can address both a mere handful of users all the way up to many thousands of users.

Given the longevity of Horizon Collaborate in the market; just 12 months, I have to say that the attachment rates to date for their Collaborate UC applications is impressive especially given the size of user that the Gamma Channel typically sells to.

The customer size spread (below) illustrates that these applications really do scale down to the smaller SME.

Gamma also sells two third party UC apps, Akixi and Cirrus that also display this scaling ability.

Are there really 5 to 5000 user applications out there successfully competing across the SME, Mid-Market and Enterprise sectors?

Alex Grant, Director at 24 Seven Cloud says typically with new technologies, new features and functions trickle downwards.

“Our stance on this is that within the Cloud services sector we are actually seeing new innovative technologies starting to be implemented at all levels, not just from the Enterprise downwards. For example, the rise of BYOD within smaller SME’s have brought on new challenges for the Unified Communications market, and innovative technologies like native mobile phone dialler integration have become a driving force to push Unified Communication sales into the SME market.

The real advantage of Cloud services is that evolution of products and services can now happen at a much faster rate than in the past. As a result, innovative new software features can be rolled out much faster, cheaply and easily to specific market verticals. This means the trickle down affect is less pronounced.”

John McKindland, National Sales Manager, Nimans, says, “In theory you can but in reality, the picture is slightly different especially in terms of successfully competing – via a one pane of glass solution. Voice, instant messaging and CTI integration are what customers require.

The other consideration is that up to 5,000 user opportunities are very rare. However, in theory if a reseller is on the correct tender then they can get involved with the right applications. Teams is one, and solutions from some of the traditional PBX vendors are also available.”

And are they cost effective across these user spreads?

John McKindland says that in terms of costs they don’t see many large deployments based on an OPEX model. “I’d say an average deployment for a standard reseller is under 100 users and where UC solutions are concerned it tends to be a perpetual licence rather than a monthly recurring OPEX model.”

Alex Grant at 24 Seven Cloud says that with regards to the cost effectiveness of UC solutions, he believes that each business is unique, and as such the requirements for a UC solution may vary considerably across SME, Mid-Market and Enterprise.

“This also goes someway to explain why the Enterprise is no longer the main driving force in UCaaS. Cost effectiveness should be ultimately measured by resultant enhanced business productivity, which a properly researched and delivered UC solution can bring to a business, no matter what size.”

What should resellers be looking for from these apparent one size fits all products in terms of vendor support?

John McKindland says that high levels of support are available from Nimans. From presales all the way through the sales cycle. On occasion there’s direct vendor support too. But these are accreditation models, not something that can be sold off the shelf. There’s high levels of accredited training spanning technical and sales knowledge needed to be able to deploy.”

Alex Grant says 24 Seven Cloud believes that the key to a one size fits all product in terms of vendor support is to choose a fully scalable solution from a vendor with a suite of products which are designed to work together from the ground up.

“All too often service providers pick and choose components from different suppliers with varying success. This sometimes results in a disjointed end user experience, with wildly different user interfaces to learn and support. By choosing a vendor with a suite of products designed to work together from the start will translate into superior reseller support.

The other consideration, is how well the platform can scale in terms of features and size. Can it support a growing business and is the upgrade path easy and trouble free?”

Grant adds that his solution is powered by Metaswitch and has over 30 million seats live worldwide – tried and tested technology.

He says, “We offer complete flexibility; our platform can be a standalone product working with an on-premise PBX, a standalone single line in the Cloud and scales all the way up to a multi-thousand seat call centre solution. Therefore, it can work outstandingly well for any business at any stage of their Telecoms/Cloud journey.”

Grant adds that historically, one might logically expect that the more feature-rich the seat license is, the greater the impact on support departments. “However, with a properly designed platform, with intuitive interfaces, and a simple upgrade path, it is possible to deliver a solution that is genuinely simple to use and support at all levels from SME all the way up to Enterprise.”

Paul Taylor of Voiceflex says the deployment of applications has been changing for many years. “The UC&C market isn’t coming from the traditional vendors, it’s been developed from social applications, such as WhatsApp, it’s fully federated and free of charge. There are 300 million active users, with 3 million companies using WhatsApp business and there are 2.5 billion monthly active users which can be federated.

Let’s remind ourselves Facebook was formed only in 2004, 16 years ago and Workplace by Facebook now has an extensive list of worldwide clients. Microsoft Teams is fully UC&C which is included within Office 360. With MS products, the user experience is the same regardless of the size of the instant.

Just using these three companies as a reference point, most of us will be in a number of WhatsApp groups, which could be a company using the app for verbal, visual and written communications. Add in document sharing to provide a full UC application and the cost is free of charge. Therefore, with UC&C you set up one user and federate. The number of clients or end-users is to a large extent immaterial.

The same applies with any paid version of UC&C; you pay per user and the size of the opportunity is immaterial and the user experience will be the same whether you are a 5 or 5,000 user site.

Vendor support? That’s old school and with every telephony application having, or in the process of adding, connectivity to MS Teams, how long will it be before they add in Workplace by Facebook or WhatsApp Business?

The telecommunications market has always been fast paced and the uptake of UC&C within the social and business area is the fasted uptake I have ever seen, and resellers should be looking at how they adapt to the changing market.”