In 2016 the landscape began to change for IP based voice services as sales of IP trunks

slowed whilst hosted VoIP sales began to soar.

The problem with any market positioning statement is that it is a snapshot of what is happening at that time and therefore until you can see a series of pictures it is often hard to see if you have a trend or a one-off market event.

One such snapshot was revealed last September when the Cavell Group announced that their research showed that users were ‘leapfrogging SIP to a hosted VoIP solution’.

You take news such as this on the basis of who is saying it and why. If Broadsoft had done this research then you could say that they might have a vested interest in that kind of result but then you have to remember that Broadsoft also supply SIP trunks so they would be a winner either way. If say 8x8 had announced the shift to hosted telephony that could be a different story. However, it was Cavell, the analyst firm that really has no commercial axe to grind in breaking such news. So, hanging my hat on Cavell’s say so - it’s going to be accurate then.

This is what Cavell said:

Cavell Group’s latest IP Voice market reports show unexpected market dynamics, with the SIP Trunking market performing slower than expected and the Hosted VoIP market continuing to grow strongly.

Cavell had seen strong growth across all segments of the Hosted VoIP market in the last six months. The market has shown 11% growth reaching a total of 2,423,123 Business Hosted VoIP seats, while the SIP Trunking market has only grown 9.94% in the last six months to a total of 2,113,528 SIP trunks.

This is a slowdown in the migration from ISDN to SIP Trunking and may show that customers are leapfrogging SIP to move directly to a hosted solution.

In the previous six months (June to December 2015) the SIP Trunking market had grown by 13.73%, hence during these six months the market has suffered a slowdown, which Cavell believe is due to a few key factors, such as BT’s announcement of 2025 as the End-of-Life of the ISDN Network having yet to stimulate customers and providers to make immediate migrations. Also, the market for SIP is becoming increasingly competitive from a price perspective, leading service providers to drive customers toward more lucrative Hosted VoIP solutions, and lastly, easy-to-migrate customers have already moved, meaning the remaining customers may need specific technical or commercial considerations.

Matthew Townend, Director of Research & Consulting at Cavell stated: “There is probably not one Call Centre in the land that has not migrated from ISDN to SIP, but the remaining approximately 50% of the market set to migrate, is going to need more compelling commercial and technical reasons to move.

If providers do not build a migration plan for their ISDN customers, they are likely to see the Hosted VoIP providers move them to their services before they react.”

Compelling?

So what would make a compelling case for SIP trunks?

Well we all know that SIP can be much faster to install than ISDN (an argument rapidly disappearing as fast as ISDN) and that it is a far more flexible service – another argument heading south. How can SIP be better that something set to not exist?

The cost argument has a few years to run but few take in to account the cost of SIP security when quoting customers and prefer just the headline cost per trunk comparison.

So, I’ll ask again, what makes a compelling case for SIP? Well the DR/BC angle is useful to push and will remain so in most use cases.

Is there a compelling case for Hosted VoIP?

Well look, if you have a vested interest of course a case can be made and it will appear compelling for either SIP or Hosted Voice but the fact of the matter remains that users seem to be voting with their feet and moving to the Hosted VoIP option.

We are of course still to see the impact of Microsoft’s Cloud PBX which was ‘launched’ in the Autumn of 2016.

It remains therefore to eagerly await the next series of research figures from Cavell which are due tantalisingly soon.

Going Mobile

We are an increasingly mobile planet. As we move around, no matter what the distance, the need for continuous, seamless if you prefer, connectivity has grown exponentially.

3G was pretty useless, albeit better that what we had before. With 4G applications on the move become far more practical but you do need an increasingly generous data bundle to prevent potential bill shock – such is the rate of data consumption growing.

5G is, in the scheme of things, literally just around the corner but cost and usage deals some way off at this stage. 5G, more than the anticipation of 4G, does however have far more of a connectivity promise attached to it.

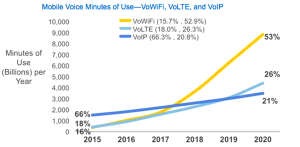

VoWiFi

Several global mobile carriers have recently launched or announced a launch of voice-over-Wi-Fi (VoWiFi) service. Voice over Wi-Fi is not a new concept, but the earlier solutions had several limitations that affected the adoption and ultimately the end-user experience. Since then several enhancements in VoWiFi that now make it a carrier-grade user experience have been made. This service can now be offered independent of the hardware capabilities of the device as long as the device has Wi-Fi enabled on it, even nonsubscriber identity module (SIM) devices such as Wi-Fi-only tablets can have this service turned on.

VoWiFi not only can extend the reach of MNOs by enabling them to deliver a cost-effective, scalable, and quality solution for delivering in building coverage, where cellular coverage might be sketchy, but also can help them battle the erosion of revenue from over-the-top providers’ (OTTPs’) voice-over-IP (VoIP) offers. VoWiFi is also being positioned as a complementary service to voice over LTE (VoLTE); they are both IP Multimedia System (IMS)-based and can offer a rich set of value-added services. In fact, VoWiFi can help solve the challenge of maintaining accessibility and quality of service for mobile users’ indoor use and also help reduce the roaming charges on the bill.

The Mobile Network

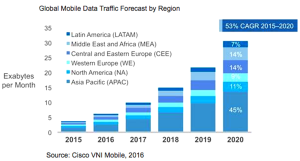

To illustrate the growth in mobile data here are some key highlights from Cisco’s Global Mobile Data Traffic Forecast Update 2015–2020 White Paper (Published January 2016 so we will update this when the 2016 figures are available)

Global mobile data traffic grew 74 percent in 2015. Global mobile data traffic reached 3.7 exabytes per month at the end of 2015, up from 2.1 exabytes per month at the end of 2014.

Fourth-generation (4G) traffic exceeded third-generation (3G) traffic for the first time in 2015. Although 4G connections represented only 14 percent of mobile connections in 2015, they already account for 47 percent of mobile data traffic.

More than half a billion (563 million) mobile devices and connections were added in 2015. Smartphones accounted for most of that growth. Global mobile devices and connections in 2015 grew to 7.9 billion, up from 7.3 billion in 2014.

Smartphones (including phablets) represented only 43 percent of total global handsets in use in 2015, but represented 97 percent of total global handset traffic. In 2015, the typical smartphone generated 41 times more mobile data traffic (929 MB per month) than the typical basic-feature cell phone (which generated only 23 MB per month of mobile data traffic).

Mobile offload exceeded cellular traffic for the first time in 2015. Fifty-one percent of total mobile data traffic was offloaded onto the fixed network through Wi-Fi or femtocell in 2015.

What is an Exabyte? Think of it this way—five Exabytes of content were created between the birth of the world and 2003. In 2013, 5 Exabytes of content were created each day.

Ed Says…

I can’t stop writing this any more succinctly. In 2015 I wrote here, “This market has always represented a moving target for the channel and who here could ever honestly recommend a long-term access contract to a customer without laughing all the way to the bank. Keeping a close watch on the market is essential for resellers providing connectivity whilst recommending the right service for their customers is even harder.” The only thing I would add to that today is keep an eye out for 5G and that it’s getting even harder these days.”