The pandemic has been first and foremost a medical emergency, but it has also had an impact on the economy. Several sectors – from travel to hospitality – have had their business operations put on hold at various points over the last 18 months. Investors with a specialism in those sectors have instead been eying up other opportunities. As such, now is a good time for channel companies to seek financing options.

Nigel Cook, founder and group managing director, Evolution Capital, discussed how the slowdown in other sectors has fostered interest in technology, media, and telecoms (TMT). “Investors that invested in other spaces can’t find businesses that meet the criteria of their funds anymore, therefore that money is coming into [TMT]. That’s doing two things, creating more competition and putting prices up, but also means some of the new entrants are looking to be more flexible with their offerings.”

Channel companies can be firmer in their expectations, as many investors showing more flexibility than in the past. Cook explained, “Rather than looking to buy the whole company, investors are willing to buy half. This gives entrepreneurs a chance to share in the growth of the business. It’s a good time to sell your business, because values are strong, and it’s also a good time for entrepreneurs to look for equity investors, because there’s lots of new funds around.”

There are broad and varied reasons why channel companies might be looking to start a process, explained Emma Ladd, solicitor in the M&A division at Gardner Leader. She said, “The reasons behind mergers and acquisitions are as varied as the parties that undertake them. From a seller’s perspective, they might be retiring, want to try something else or just been made an offer they couldn’t refuse. From a buyer perspective, they may be looking to bolt a product or distribution chain onto their existing business, buy out a competitive product or just increase their market share. A merger type arrangement will often happen when two parties feel that they can work together more effectively or efficiently than if they were to compete.”

In terms of other drivers of mergers, acquisitions and investments, Richard Thomas, founder and CEO of Highlight, discussed the influence of emotion. He explained, “Surprisingly, emotion is a big one – bigger than it should be. Large acquirers often don’t know much about the target’s technology – that’s why they want to buy them – and suffer from fear of missing out, or of someone else snapping up the target. Sometimes they’re sitting on a cash mountain and simply need to spend it. Due diligence can be minimal in these cases. On the flip side, the company up for sale can have skittish directors, or an irrational fear of a large competitor, or a short-term peak in media coverage that the directors want to exploit… just remember emotion is a huge influencer here, watch out for it on your own side, and be ready even to exploit it if you see it on the other side of the table.

There is currently a lot of merger and acquisition activity in the network services space. Full Fibre was acquired by infrastructure investment fund Basalt back in December. Under the terms of the deal, Basalt took a majority interest in Full Fibre and will provide both capital investment and additional management expertise in scaling infrastructure businesses. Oliver Helm, the company’s CEO, guided the company through the process, with the deal designed to support Full Fibre’s ambition to spread its wholesale fibre infrastructure to at least 500,000 additional premises by 2025.

He commented, “At the minute, many channel M&As are focused on establishing a strong fibre customer base, as fibre customers are far more likely to stay for the long-term customers due to the increased reliability, 24/7 monitoring and bandwidth scalability.

“M&A is the fastest way to increase footprint and can potentially reduce the competition by avoiding the overbuild alternative. The increased footprint becomes much more attractive to larger ISPs with many looking to hit a minimum of 100K premises.”

In terms of why this sector is ripe for investment at the moment, Helm said, “There are a number of other factors at work. The market is suffering from a hardware shortage following Brexit, Covid and the huge demand for equipment through lockdown, as well as staff shortages. With the likes of Openreach and Virgin building fast and leveraging their market share, any competition will require significant resources to effectively compete, with M&As certainly supporting such an aggressive strategy.”

Making a start

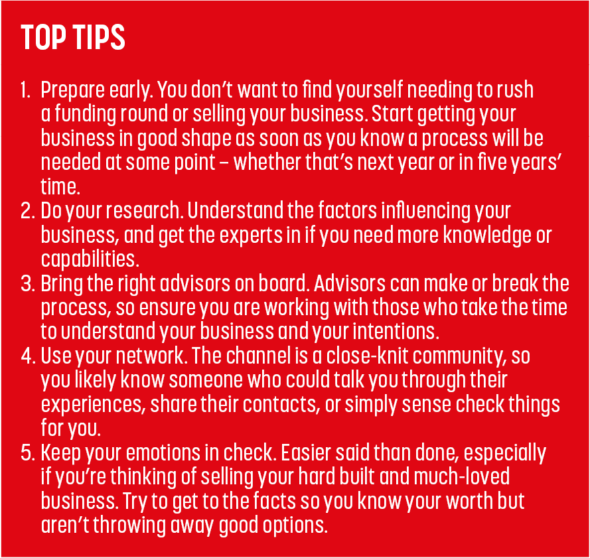

There are several key steps a reseller or MSP should go through when considering mergers and acquisitions, or indeed being acquired. Ladd, from Gardner Leader, outlined the steps she would advise a company should take. She said, “When considering any form of M&A activity, both parties need to consider whether the commercial deal is a good one for them. Once they have checked this, both parties need to prepare their business for the deal. For a seller, this might mean putting the business into the best position, such as ensuring that they contracts are up to date and that any product issues have been dealt with. From a buyer’s side, this is often about reviewing their own business to see how the transition will work. This could include increasing IT capacity to allow for the additional workload, assessing the workforces to see there are savings that need to be made or preparing for the marketing and PR that such activity will generate.”

Ladd also discussed the options channel companies have when it comes to financing these activities. She said, “A lot of M&A activity is self-funded, normally through retained profits in one or both businesses. Lending is available for such activity if the buyer has a good trading history, although this can be expensive and, if seeking funding from an institutional funder, such as a bank, they will often have a considerable number of their own requirements which will need to be met.”

What is vital is that the company looking to raise finance has their business ready for the process. Doing the work of backing up your valuation, for example, can safeguard your business from losing value during due diligence. Oliver Helm, CEO, Full Fibre, explained, “While there are many options – from crowd funding, bank loans through to investment or a partial sale to another MSP – the key is having the market data that proves your valuation.”

Assessing advisors

Businesses do not go through funding rounds, mergers and acquisitions on their own. Advisors play a starring role in the process and are foundational to success for both parties. This means resellers and MSPs need to equip themselves with the know how to approach potential advisors. For Gardner Leader’s Ladd, choosing which advisers to work with “is a question of trust”. She added, “You are trusting them with your business, whether that is making sure that you are not buying a duck or ensuring that your exit and multiple years of hard graft is rewarded. If you do not already have a good relationship with solicitors or accountants, ask a trusted person who they use. However, nothing is a replacement for talking with your prospective advice team and making sure that they are people you can work with.”

Evolution Capital’s Cook explained his consultancy’s approach to delivering on client expectations. He said, “When I founded Evolution Capital in 2003, with Grahame Purvis, most of the corporate finance businesses in the market were run by accountants. We were the first boutique to be established in the UK [that was] wholly focused on the telecoms and IT sector, and the business was run by two senior executives from the industry. What we brought was an understanding of the business and, having been entrepreneurs ourselves, an understanding of what entrepreneurs go through when they grow a business. All of the obstacles they face and getting the business to a point where they want to realise the value and run a process. It was about bringing industry experience to the corporate finance and telecoms space.”

Full Fibre’s Helm pointed out that businesses preparing for this type of process need to set aside time and resources. He said, “Advisors have great connections and can open big doors, with the insight and knowledge to help you pull together a very compelling business case, tailored to your preferred investor or acquiror – but it doesn’t come cheap or easy!”

This will not happen overnight, Helm explained, as your advisors “don’t know the business as well as you”. Data and statistics will give your advisors a tangible understanding, so ensuring these are readily available is essential. He added, “The more understanding you have of the market place, your competition and potential customers the better, an advisor will steer you but the final pitch is likely to be by you and the investor needs to have the faith and belief in you and your data.”

Thomas, from Highlight, said resellers and MSPs should approach potential advisors “very carefully”. He explained that a referral is preferable to working with an advisor that has cold-called you. He added, “Don’t be flattered by getting a call from someone saying what a great business you have – large M&A companies employ teams of people specifically to court promising companies. If you take a “tell us more about your business” call, make sure you get something out of it too – ask about how they’re seeing the market, deals they’ve done, what acquirers are looking for. Don’t trust any one set of answers, but do a few and you’ll see some common themes.”

Similarly to Full Fibre’s Helm, Thomas highlighted the importance of setting aside time. He said, “Better to play the long game, keep acquisition in mind over a few years and have gentle conversations around the subject – conversations along the lines of “at some point we will want to do this – how do you see the market?” are much easier than “We need to do this now – what can you do for me?””

Learning from peers

Raising finance or considering mergers and acquisitions can be an emotional, stressful and painstaking process for a business. Advice from fellow channel companies that have gone through these processes – from what they learned to what they might do differently in future – can be incredibly helpful.

Highlight’s Thomas advised keeping a clear head, despite what might happen throughout the process. He said, “The thing I learned is that the acquisition process can be very toxic for the acquired company. As soon as the process starts, it tends to become the centre of gravity for the business – not a good thing. The price will normally be based on targets set by the acquirer, expectations defined in terms of revenue growth, profitability in the period leading up to closure of the deal. The parties know that if these targets are not met, it will be an excuse for a reduced price. So, there’s a tendency to take on questionable business, deals that wouldn’t normally be done, perhaps at extremely low margins just so that the deal keeps the revenue growing. Or, you defer purchases or hires to control costs - things that would help the business long-term, but impact the short-term picture.

“Always allow for the fact that the deal may not ultimately go through, and you will be left holding the business and needing to go forward with it. Do not allow the acquisition process to distort the day-to-day running of the business, or change your priorities. Simple rule, but hard to follow in the heat and excitement of a potential deal. Ultimately, you can end up in a situation where you’re no longer keen on the deal being offered, but have to take it because you’ve spent the last six months believing it’s going to happen and have run the business on that basis, backing yourself into a corner. I didn’t go this far, but looking back on a deal that ultimately didn’t go through, I realised I had made decisions that I wouldn’t normally agree with, and that I’d have to live with. I’ve since spoken to other business owners who’ve experienced the same thing.”