Digital transformation has started and is having a significant impact in financial services. The need to reduce costs and replace legacy equipment are seen as the major drivers of change, but this is very closely followed by the need to increase customer engagement and targeting.

Digital transformation is a vitally important process for the financial sector as a whole, and for individual companies that need to keep up with their competitors. Added to this are the pressures of evolving technology, new entrants threatening to use their agility or massive resources to enter the market, and the introduction of ever more regulatory changes and the uncertain political landscape. In all, financial services companies need to invest in digital and be ready to harness the ability this brings to navigate complex situations.

According to a recent survey by information management software firm Opentext, the current picture in the sector is healthy, with nearly two thirds of surveyed firms already deploying or close to creating a transformation programme, and only two per cent still to plan at all. Within the sector there is no particular evidence of any one area (such as insurance) being further ahead or further behind, and it appears that all industries are travelling at the same speed.

The banking industry is experiencing disruption at an increasing pace. Over the past few years, traditional financial institutions and non-traditional fintech firms have begun to understand that collaboration may be the best path to long-term growth.

For most fintech organisations, the primary advantages are an innovation mindset, agility (speed to adjust), consumer-centric perspective, and an infrastructure built for digital. These are advantages that most legacy financial institutions don’t possess.

Alternatively, most banking institutions have scale, a stronger brand recognition and established trust. They also have adequate capital, knowledge of regulatory compliance and an established distribution network.

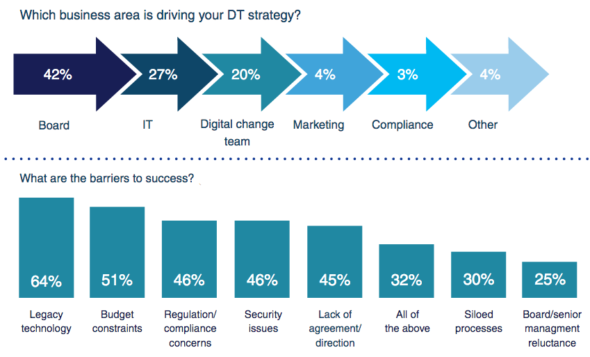

Looking at the findings of the Opentext survey in terms of where in the organisation the push for digital transformation is coming from it’s disappointing to see that the marketing departments have just not got their heads around the need or the potential benefits. I would therefore question whether the outcomes arrived at by the investments might not actually be customer focussed.

Given that one of the key objectives for digital transformation in this sector is customer service excellence, this potential in not addressing the needs of the customers could be disastrous and leave many organisations that get their transformations wrong wide open to competitors that get it right.

In terms of what the channel makes of this we put a number of questions to players in the market to get further reader feedback.

What are the IT and Comms trends in this sector?

Carl Boraman, Director of Strategic Alliances at Tollring, reminds us that the finance/banking sector is a highly competitive global marketplace.

“It is also one of the most heavily regulated with organisations under constant scrutiny to adhere to continued governance such as PCI compliance, Dodd-Frank Act compliance, MIFID II compliance, and GDPR compliance.

Cyber Security is a top priority as these organisations strive to prevent cyber-threats, hackers and malware. If these companies don't protect their customers, then they're going to lose their trust, and a poor reputation can be more harmful to a brand than any fine.

The early adopters in the industry are constantly exploring new technologies to increase workforce mobility and remote working. In contrast, more established firms are still working to move from legacy, locally built communication tools to cloud solutions for flexibility and scale. All are striving to deliver improved customer service and interactions that drive down cost and improve customer satisfaction.”

John McKindland, Head of Solution Sales at Nimans, says the finance and banking sector continues to innovate and focus on speed of adjustment.

“Being agile is key especially with increased customer demand around higher expectations of service. Internet banking, quotes online and instant access to information are all crucial as well as when in branch interacting with staff.”

Iain Sinnott, Head of Sales at VanillaIP

Essentially, we see this sector as one that is reacting to the change in customer expectation and the public’s increasing willingness to ‘switch’. Whilst obviously governed by the strict compliance rules that relate to this sector, flexible multi-media inbound and outbound call management is key to winning and retaining business.

Which products and services are selling well?

“Collaboration tools and data analytics are selling well,” says John McKindland at Nimans.

“Increased regulations also have an impact on how and which types of technology can be used. For example it could be call recording and auditing conversations. There’s GDPR and MIFID II to consider. The industry has more regulation compared to before the big banking crash. Web chat, bots and AI will continue to grow along with continued investment in call centres for general customer advice.”

Carl Boraman at Tollring says the core technology investments are coming from cloud communications, security of networks and data storage.

“Security protection is always a good seller. The area requires continual investment with the focus on network and services security, testing for resilience, and being constantly vigilant in preparing for attacks.

To help customers achieve compliance, our resellers are expanding their provision of audit and monitoring tools. The sector has a legal requirement to record calls, so providers must ensure that call recording technology is up to the job, safe, secure and will protect as well as meet regulatory compliance needs.

Training continues to attract investment. This applies to reseller staff as well as customer employees. Education and awareness amongst staff around highly evolving technology is needed to ensure they are aware, trained and vigilant, and that they can use it properly to adhere to compliance.

Cloud services is expanding fast. More and more resellers are moving from selling physical products to managed services such as secure resilient clouds for hosted apps. The benefit of cloud services is that they deliver valuable analytics and insights to resellers across multiple customers. In addition, cloud services are quick and easy to provision, support and manage with no on-site installation.”

“Un-surprisingly call recording, storage, recovery and automated archiving are key factors in this space,” says Iain Sinnott at VanillaIP.

“Many customers need help in understanding how services can be utilised and kept safely within MiFID II and partners who can exclude common services like call forwards, that bypass call recording, can really have an advantage.

How is the purchasing behaviour of this vertical changing?

John McKindland at Nimans, “When some of the tenders come through from our partners it’s clear to see there is more emphasis on working with key specialist suppliers rather than a one solution fits all approach. That could be a headset refresh programme or IT peripherals or perhaps distinct software providers.”

Carl Boraman at Tollring points to this being a fast-changing market that is particularly impacted by the growth of millennials.

“These younger financial customers want 24/7 access, social media and easy access on various unified communications mediums.

However, there is still a need to cater for the ageing population who may not be so technologically advanced. Financial organisations and their providers must not lose sight of their customers’ wide variety of needs and most specifically, to be aware that the phone still plays a big part in customer service today.

Personalisation of services is another growing requirement. Communicating to such a segmented market can be a challenge but fortunately, as communications move into the cloud it also becomes easier to gain insights and thus improve personalisation.”

What are the major considerations for partners wanting to enter and succeed in this vertical?

John McKindland at Nimans advises resellers that this is a very mixed and dynamic sector where you don’t need to specialise too much at the lower end such as Estate Agents, IFA’s and solicitors.

“You need to understand the regulatory environment where call recording and audit trails come in – but other than that it’s quite a simple sell. But the more corporate you go you need to specialise and have access to specialist vendors. Those that provide extension side call recording for stock market trading rooms is one example.”

Meanwhile, Carl Boraman at Tollring, says “Resellers need to go the extra mile to build assurances into their proposition so that if/when a fintech customer is targeted, they know they have the backing and support of a supplier that has built fully documented processes and substantiated security into the proposition. This requires resellers to look for peer-to-peer relationships with suppliers who offer similarly relevant propositions.

Resellers must be able to show how customers can bounce-back and recover after an attack and get back to business-as-usual within acceptable timescales. It’s not enough to rely on the end customer to do risk assessment, it has to be central to the proposition in order to minimise reputational damage. This should cover root-cause analysis, stress test proposition to prove ability, what backup mechanisms are in place such as being able to flip from on-premise to cloud ICT.”

Iain Sinnott believes that “Compliance is a relative thing so the level to which a business in this sector needs to demonstrate steps, to prevent staff circumventing compliant procedures, is relative to their size and the value of transactions; understanding this is a key part of doing a good job in this space. Once you understand the compliance parameters, you can work in this sector with all the great call management tools and productivity tools that can support them.”

Can you be a generalist or is it essential to specialise in this vertical…why?

“The main challenge facing resellers is having to maintain their knowledge of compliance and the increased regulation around continuous monitoring which favours those who specialise in the sector,” says Carl Boraman at Tollring.

“Those who already have experience delivering agile cloud solutions and mobility will already have a greater understanding of the compliance needs in finance and banking.

The benefit of being a specialist is that they can demonstrate their skills and knowledge to their finance customers and show that they can deliver solutions to real-world problems. This requires highlighting work done elsewhere to build credibility.

They will also need a highly qualified set of products and services that have security and compliance requirements already built-in to deliver piece of mind to their finance and banking customers.”

Iain Sinnott at VanillaIP offers some pragmatic advice.

“If you want to sell to a large investment bank you need to be a specialist, if your focus is a small pensions and investment broker you can be a generalist, but you must understand their compliance obligations and the limitations of your portfolio. Their solution options will be more restricted than a standard business.”

Business Trends In Banking

James Buckley, VP and Europe Director of business consulting, information technology and outsourcing services firm Invosys, says the last few years have seen several non-banking companies such as technology majors, digital upstarts and FinTechs steadily expand their foothold in the financial services space and that non-banking players are perceived as drivers of innovation in the industry.

Buckley sees the following trends in the marketing.

1. Open banking

Pushed on to this path by open banking legislation in 2018, banks will refine their vision and strategy this year, and also evolve their roles as product manufacturers, marketplace operators, distributors or a combination of the three.

They will hope to emulate the likes of Amazon – which gets 40 percent of its business through recommendations – by using extensive analytics to improve their understanding of customer expectations and fulfil them with contextual and personalised offerings.

2. Customer journeys move ahead

In 2019, banks will find a clear correlation between their quality of customer experience and business performance metrics. In July last year, the Institute of Customer Service published that banks with a higher UKCSI (United Kingdom Customer Satisfaction Index) score than the norm for the sector gained 8,675 current accounts on average compared to the rest, who lost an average 3,457 accounts.

3. Security remains in focus in 2019.

Cyber threat will continue to intensify in 2019, as hackers target AI-based solutions with AI-based attacks in a reminder of the 2016 offensive on the Microsoft chatbot Tay that led to it sending out objectionable Tweets. Don’t forget GDPR.

Ed says…

2019 is bringing several changes in the banking workforce and culture as GenZ joins the ranks. Digitisation will create demand for skills in cyber security, data science, and automation. Since universities rarely produce market-ready graduates, banks will need to bridge the gap with training and collaboration.

All are opportunities for innovative and versatile channel resellers.