|

If cellular operators sit on their hands and prognosticate over various business models for mobile TV, then broadcasters, broadcast network owners and handset manufacturers will make the market in their own image. Peter White of analysts ReThink Research thinks the only way out is general adoption of a free-to-air model – and he has the facts to support that view …

The big problem with mobile TV so far has been that it was the property of the cellular operator, built around unicast cellular streaming technology – a technology which largely doesn’t work, looks awful and which inefficiently uses network resources. And yet today each of the major cellular operators has too much invested in cellular unicast video and all the content relationships that go with it, to give up on what right now looks like a very unpromising business.

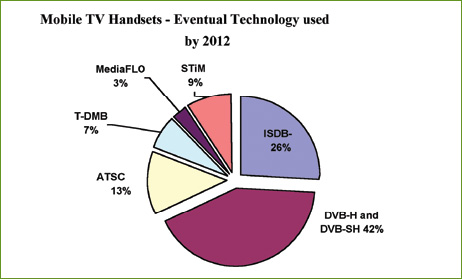

But it’s easy to understand why cellular operators have reached this point. Over the past three to four years mobile TV technologies have multiplied rather than consolidated. Despite an early dominant lead by DVB-H, in what seemed a two horse race with Korea’s T-DMB, there are now at least 15 separate mobile TV technologies that operators can bring to bear (see the box). An operator that chooses the wrong one could end up down a business-model blind alley.

In the worlds of one investor: “so it’s just a mess?” It might appear haphazard for operators, but the world is settling on a handful of these technologies; and they are being forced together into what will become a number of blended service types, working side by side on the same device.

Which business model?

Increasingly it is not the technology choice that is difficult to make – that is often dictated by local geography or local politics. Instead it’s the correct business model that is the hardest thing to grasp.

For Europe, at first it seemed that pay-TV was the definite way to go. This is what the parent of DVB-H technology, Nokia, has been preaching since 2003 – a combination of low priced subscription and a partially subsidised handset, or a TV service subscription included in a bigger voice and data bundle, and supported not by all-out advertising but with pre-roll sponsorships.

During the past year those countries which have adopted a “free-to-air” policy

have shifted far more mobile TV handsets – but this does not mean that any operator is making money out of these networks and devices. Sometimes operators are forced to back mobile TV not because there is a crystal clear business reason to do so, but because it would leave them as the odd one out for not launching, and so drive up their churn.

Despite this, Japan has now shipped more than 20m ISDB-T mobile handsets, and Korea has 8m T-DMB devices (many of which are not handsets). Chip suppliers and device makers are flocking to mobile TV.

But those services do not guarantee any improved ARPU; and many Western operators, such as Verizon and AT&T, are now looking at mobile TV purely as a threat to be countered rather than a service to be offered. They prefer to spend their money pushing inferior streamed cellular video services – which at least add something to ARPU, even if it is for a minor percentage of their total customer base.

In the US AT&T has for the most part copied Verizon in using Qualcomm’s proprietary FLO system on its MediaFLO network – not because AT&T thinks it’s a good way of offering mobile TV, but just so Verizon cannot gain the upper hand.

But although AT&T may be more interested in what Verizon can offer than what consumers want, none of the global cellular carriers will be able to hold the mobile TV tide back forever.

Coming ready or not

|

begun to scale in some parts of the world, and inevitably it’s beginning to be understood.

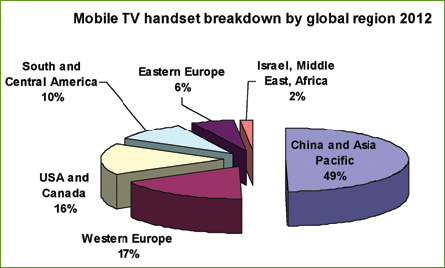

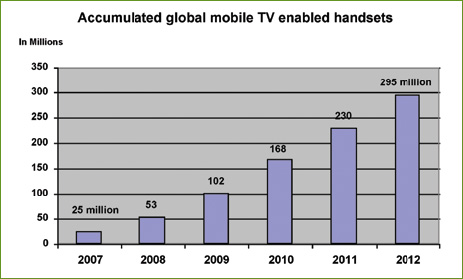

Across a number of key mobile TV technologies a new report from Rethink Technology Research in the UK entitled Searching for a Mobile TV Business Model – Global Handset and Technology Forecast 2008-2012 predicts that 295m specialist handset devices which can receive one or other format of mobile TV will be sold by 2012.

A further 61m devices which are not handsets will be added to that, making total shipments of 356m devices which can view mobile TV.

be countered rather than a service to be offered …

But that’s probably not the key important fact that comes out of this report. Handset transition is key to the emergence of mobile TV services, and this is seen to be more than three times faster markets where a free-toair mobile TV business model is adopted. If cellular operators want to get to a point where paid mobile TV services generate ARPU, the shortcut route is to provoke the mass transition to mobile TV enabled handsets using a free-to-air service – and from there kick on to offer premium services.

Other revenues are available from EPG-triggered advertising, channel change advertising, and over-the-airways media asset sales, to augment free-to-air TV service payments. But once again, these rely on there being enough handsets in the wild for mass adoption of TV viewing habits to take place.

This has already happened in Japan and Korea. It is likely to be repeated shortly in Brazil where the ISDB-T technology of Japan is being used, and in China where for the first year at least free-to-air content will be delivered. In Italy on the other hand we can draw the only example of a typically European route to market; there 3 Italia still dominates, with a paidservice approach built around exclusive and shared live sport events, advertising control on its own two channels and clever bundles that include around 19 of ARPU for the TV service.

Because they expect to adopt paid mobile TV services, the US and Europe will initially see slow progress, using content which is already consumed over cellular streaming unicast TV services rather than making the best of the vastly superior quality broadcast that mobile TV technologies can bring.

Most mobile TV broadcasts begin with what would be a 500 Kbps stream (if it was encoded as a constant bit rate stream) compared to around 70 kbps to 120 kbps for the bulk of unicast video streams – on the same screen size. The difference is seen in dropped frames, pixilation, ghosting and loss of lip synchronisation.

What is likely to happen is that cellular operators fixated on ARPU will make room for more broadcast-based technologies such as ATSC M/H and DVB-T2. Those in turn will promote more free-to-air approaches in the richer economies.

But this will not happen until the paidfor mobile model has failed and these new technologies come to market, say by 2012. It is only then that their spending power will begin to see them catching up on the Asia Pacific region.

By contrast the Asia Pacific free-toair services will find advertising-only approaches tough to bring to profit, due to their immature advertising infrastructures. Eventually premium services will emerge which leverage off the rapid handset transition of free-to-air, and offer hybrid services – part free, part paid.

It is only then that mobile TV will reach its full promise, emulating existing terrestrial TV with its free, paid, premium, pay-perview layers.