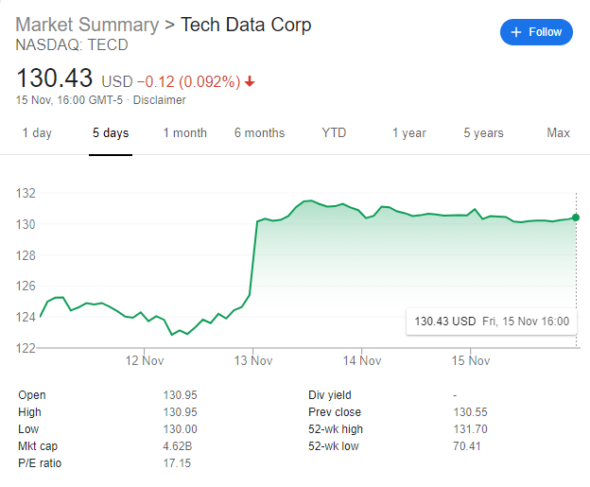

Apollo will pay $130 per share of common stock, which Tech Data said is a premium of nearly 25 percent over its average closing stock price for the 30 days before news of the offer surfaced.

“Tech Data has built a great culture and a great team over the last 45 years,” said Tech Data chief executive officer Rich Hume. “This sale acknowledges that we are the premier IT distribution firm in the industry.”

“Tech Data is vitally important to this community, and is a shining example of the type of industry we want in this county and region," St. Petersburg Mayor Rick Kriseman said. "The world is paying attention to them and us, and we expect them to continue to thrive for many years to come.”

Tech Data is No. 88 on the Fortune 500 list of largest publicly traded companies. It has more than 14,000 employees worldwide, 2,000 of them at its headquarters near St. Petersburg-Clearwater International Airport.

The sale must be approved by stockholders and regulators in other countries where Tech Data does business. Assuming that happens, the deal is expected to close in the first half of 2020. When it does, Tech Data will become a privately held business instead of a publicly traded company. Hume will remain the CEO.

“Excellent deal for shareholders. I’m one of them,” said former Tech Data CEO and board chairman Steven Raymund, whose father founded the company.

The buyer, Apollo Global Management, is huge, with $323 billion in assets.

“There’s a lot of action right now in the private equity world,” he said. “Many of these private equity firms are loaded to the gills with cash. Interest rates are low.”

Moreover, “Tech Data’s valuation was attractive, I think, for a private equity company because of its cash-generating abilities,” Raymund said. “Distribution companies are very popular targets with private equity because of their generally light fixed capital footprint, which means they don’t need to continue to make a lot of investment to grow other than in working capital.”

Tech Data buys a wide range of servers, computers, printers, phones, cameras, tablets, copiers, scanners, software, cloud services and more from manufacturers like Apple, Cisco Systems and HP. It sells those products and provides service and support to clients in more than 100 countries through a network of 11 logistics centers, six of them in the United States.