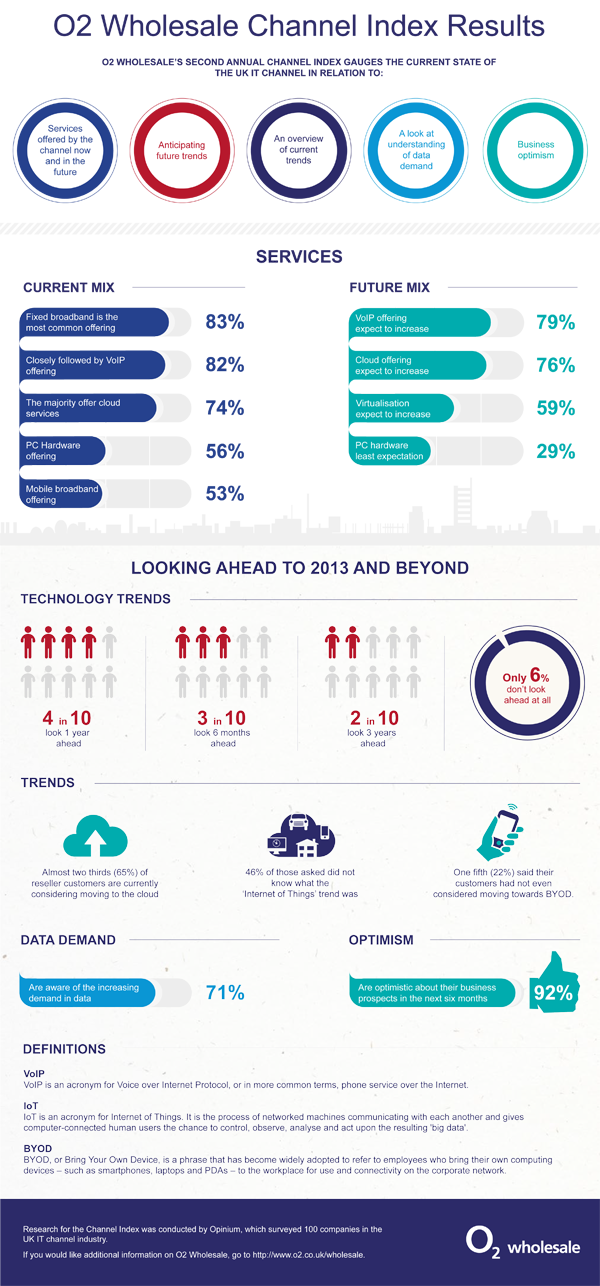

The second O2 Wholesale Channel Index, which surveyed companies in the UK IT channel industry, found that VoIP, cloud and virtualisation are the major business focuses for resellers and will continue to be as the year progresses.

The key trends in the IT channel were also examined and research found that the Internet of Things (IoT) is becoming a genuine proposition for resellers and is set to move from a buzzword to a business generator. The widespread adoption of BYOD, the proliferation of cloud and the sustained popularity of virtualisation are also highlighted as trends driving demand for fixed line broadband.

In this report we examine the findings in more detail and highlight the growth opportunities for the channel.

IT channel focus and growth areas

The first port of call for the Index was to examine the current mix of services offered by resellers. Fixed broadband remains the most common offering, with 83% of those questioned claiming to sell the service. This was closely followed by VoIP (82%) and cloud services (74%), while mobile broadband (53%) and PC hardware (56%) are less major constituents of a reseller’s business.

This focus on VoIP and cloud offerings amongst resellers is sensible as the cost savings, efficiency and scalability that they provide prove increasingly attractive to businesses.

Expected growth areas

Having established the current mix of services, the natural progression was to examine predicted areas of growth in 2013. Both VoIP (79%) and cloud services (76%) were identified as key areas for growth in the next six months, with those surveyed expecting increased uptake this year. Other areas of expected growth include virtualisation (59%) and mobile broadband (52%), while only 29% of those surveyed expect an increased uptake in demand for PC hardware.

Business optimism

Despite continued tough economic conditions, the channel is confident about business prospects over the next six months with the majority of respondents claiming to be optimistic (92%). This is a 4% increase from last year, when 88% professed confidence. This shows that despite the UK economy shifting in and out of recession, the channel is seen by those within it as a robust place for business, with assurance in business prospects increasing over the two years that the Index has measured sentiment.

Forward planning

The Index research reveals that companies in the IT channel put a big focus on keeping abreast with technology trends to spot new market opportunities. Nearly a quarter (24%) claim to look as far as three years ahead in terms of trend spotting, while 40% look a year ahead. For the remainder, 24% still plan six months ahead, while only six per cent do not monitor any developments in the market at all.

These results indicate that the channel is forward thinking and broadly, does not run business in a reactionary manner. Rather, the strategic thinking and forward planning of channel businesses allow them to tap into future trends and ways of working which should support the growth of their organisation.

Key trends

While there are many trends driving revenues in the IT channel, there are three which seem to be dominating column inches this year – namely, cloud, BYOD and the Internet of Things (IoT).

The results of the Index show that almost two thirds (65%) of resellers’ customers are currently considering moving to the cloud. This is very close to last year’s figure (63%), showing that it is a trend that continues to be a priority for channel players.

When asked to what extent customers are moving towards BYOD, only one fifth (22%) said their customers had not even considered moving towards the way of working. 21% claim customers are undecided, possibly because they are waiting to see if the latest trend is here to stay, and whether BYOD will really make a demonstrable impact on business. These numbers support findings from last year’s Channel Index which showed that one in 10 resellers said their customers had already moved towards BYOD and a further 9% were expected to move in the remainder of 2012.

Interviewees were asked about the IoT trend and interestingly, almost half (46%) of those asked did not know what the trend is, showing that while it is much heralded, there isn’t widespread understanding. When asked how IoT is expected to change customer demand for broadband or mobile broadband in 2013, the majority (42%) of those who understood the term expected it to increase the customer demand. Just over a tenth (12%) expects it to stay the same.

The research delved deeper into which other key trends are driving business customers to invest in their broadband capabilities. Increase in remote working amongst staff is still considered to be the main driver (82%). Almost two thirds (65%) believe it is the shift towards the cloud. Interest in big data (59%) and M2M (52%) are also key trends driving broadband investment.

Data Demand

This year, the Channel Index examined understanding of data usage. Demand on data is set to have a marked effect on the business focus of the channel moving forward as predictions, such as those made by Deloitte, suggest that there will be a bandwidth crunch this decade. The implication is that this increase will impede on end users’ data experience, with networks suffering ‘rush hour’ periods where the flow of data would be much slower than usual.

When respondents were asked about customers’ understanding of this demand, 71% of customers are thought to have awareness. This leaves 29% of customers that have not acknowledged that the spiralling demand for data will impact their business operations.

Key qualities for wholesale broadband

Broadband use is increasing exponentially as IT departments frequently rely on it to support remote, cloud and virtualised services. As such, a wholesaler’s service quality is becoming ever more crucial.

The UK IT channel believes that a reliable network is the most important quality of a wholesale broadband provider (94%). This is a significant increase from last year where it still ranked first but with only 58% of the vote. Customer support (88%) capacity (82%) and unlimited usage (82%) all ranked highly while download speed (77%) upload speed (76%) and business/consumer segregation (64%) were listed next in terms of importance.

Dan Cunliffe, Head of Partners & Strategy, O2 Wholesale comments on the results of the Channel Index

“The results of our second Channel Index demonstrate that fixed broadband continues to be a major opportunity for resellers and is driven by a mix of established and emerging technology trends such as VoIP, cloud, BYOD and IoT.

VoIP plays a leading role in the service mix of many channel businesses, while cloud will continue to do so this year as nearly two thirds of those surveyed have customers considering moving in that direction. This shows that there is now mass understanding of the cost benefits and scalability that both offer. Similarly, BYOD is on the radar of the majority of businesses, and over the coming year, it will be interesting to see whether this much-discussed trend will have finally converted into an established way of working. The Internet of Things is the new kid on the block – but only half of those asked knew what the trend is. The connectivity of machines seems to be inevitable so a lack of widespread understanding is likely to change as the year progresses and people begin to understand the business benefits of machine connectivity.

A significant number of end users are unaware of the strains that these technologies and trends put on broadband capabilities and will continue to do so in the future. As a result, resellers must look to educate their end users on the impact of their current data usage and the effects new technologies will have on it. More than ever, an unlimited usage package is vital, as it allows resellers to negate the need to either impose punitive charges to customers for exceeding capped data allowances, or throttle capacity. In turn, resellers are seen to offer a consistent, transparent service which produces more trust in the customer relationship - ultimately allowing them to sell more in the long term.

Perhaps unsurprisingly, when asked what the most important thing a broadband wholesaler could offer a reseller, network reliability came top with service and support coming in second. As more and more technologies, applications and business processes come to depend on the cloud, more is at stake for businesses if broadband doesn’t function properly. Providing end customers with quality broadband they can rely on is crucial to maintaining a trusting and long-term relationship and resellers should therefore look to broadband wholesalers who can offer a reliable network and comprehensive customer support.

In summary, when we look at today’s business landscape we see VoIP is growing in popularity, cloud technology is becoming almost omnipresent, BYOD is gaining traction and IoT is on the horizon. It is clear that there are good grounds for the optimism highlighted by our Index amongst the UK channel community. It will be interesting to see how the market develops over the next year and beyond.”

About the Research

The primary research for this report was conducted by Opinium Research, an independent UK-based market research company. The research was commissioned by O2 Wholesale to establish the key drivers and trends in broadband investment. Opinium Research conducted telephone interviews with 100 businesses within the UK IT channel. Fieldwork was conducted between 12th April and 19th April 2013.

Definitions:

VoIP - Voice over Internet Protocol. Or in more common terms, phone service over the Internet.

IoT - Internet of Things. The process of networked machines communicating with each another, giving computer-connected human users the chance to control, observe, analyse and act upon the resulting ‘big data’.

BYOD - Bring Your Own Device. A term that has become widely adopted to refer to employees who bring their own computing devices – such as smartphones, laptops and PDAs – to the workplace for use and connectivity on the corporate network.